I participated in a campaign on behalf of Mom Central Consulting for Aflac. I received a promotional item as a thank you for participating.

The scene: Spring 1996. Basement apartment. College student furnishings. CandyMan and I had just celebrated our first anniversary. I was finishing my senior year of college, getting ready to start my student teaching. And I had just taken a pregnancy test.

It was positive.

The news was exciting. Thrilling. But surprising. Neither of us expected that to happen so quickly. Our smiles quickly turned to looks of panic as we both realized that there were many questions we had yet to answer, namely…what will our insurance cover? Can we afford to have a baby?

9 months later, our first little girl was born in a hospital outside of our college town. Back then, they kept new mothers in the hospital for as little time as possible – just over 24 hours after the baby was born in my case – but we still managed to acquire quite a hospital bill during our short stay.

Our very-basic health insurance plan covered all of my pre-natal doctor’s visits to prepare for the baby but it did not cover hospital charges at all. Luckily, a few weeks before I took that pregnancy test, I was talking with a friend who had just had a baby. She told me about their situation…and the Aflac insurance that had helped them pay for it. I was able to get an Aflac policy early on, and instead of being caught off guard by hospital bills or worrying throughout my pregnancy, I was able to relax. And the bills were taken care of in the end. It was so easy.

Fast forward to 2013. It’s the first day of Spring Break. Intense stomach pains. My 16 year old can’t keep any food down. Dehydration. Two trips to the ER before appendicitis and peritonitis are diagnosed. Surgery. Four nights in the hospital.

When it comes to medical emergencies like appendicitis – or broken bones or pneumonia – parents shouldn’t have to think twice about whether or not they should head to the hospital. Medical insurance doesn’t always cover everything, and the last thing you want to do is be caught off guard by unexpected hospital bills. They can really add up.

“Every day I hear about consumers being blindsided by the costs of a medical emergency. Even with health care reform, the reality is that medical costs show no sign of decreasing which can mean higher copays, deductibles and premiums,” said Michael Zuna, Aflac executive vice president, and chief marketing and sales officer. “Our goal with the Real Cost Calculator is to not just reveal how quickly these costs can add up, but to empower consumers to be proactive when it comes to health care and prepare for the unexpected. The new calculator will also educate consumers how Aflac helps fill the gaps in their insurance coverage.”

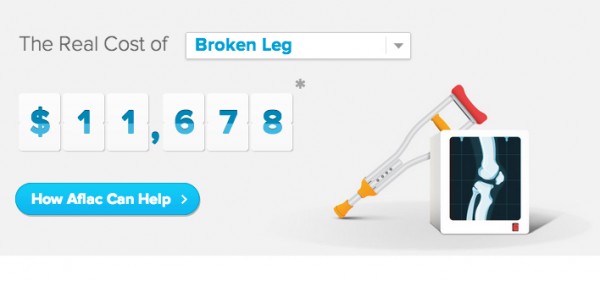

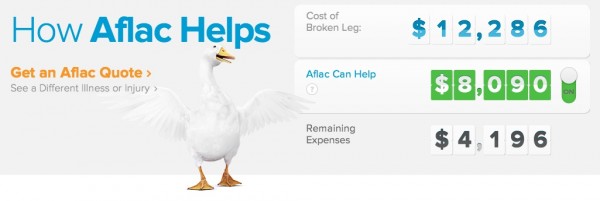

Alfac’s new Real Cost Calculator is a new tool that helps users understand how Aflac policies could help offset out-of-pocket costs as well as charges that their major medical insurance won’t cover.

How does the Aflac Real Cost Calculator work?

Aflac’s Real Cost Calculator is an online tool designed to help people understand the real costs associated with illnesses or injuries. These costs include:

- Expenses not covered by major medical insurance, such as deductibles and co-pays

- Out-of-pocket costs for things associated with hospital stays or doctor’s visits (ie – transportation to follow-up medical appointments, etc)

- Normal expenses (ie – rent/mortgage, utilities, car payments etc) that continue even if you are sick and out of work

Did you know that medical debt is the leading cause of bankruptcy in the United States? When people don’t understand the real cost of health care, they can face unexpected and often staggering medical costs. For instance, did you know that the average cost to treat a broken leg is more than $10,000? There’s no reason to be caught off guard.

Knowledge is power.

How to use the Aflac Real Cost Calculator

- Go to www.aflac.com/realcost to access the Real Cost Calculator (you don’t have to be an Aflac customer to use the RCC).

- Choose one of the medical situations from their drop down menu and adjust the personal aspects on the right (ie – how severe is the medical sitaution, what kind of major medical insurance do you have, how much do you pay in rent, etc).

- Check to see how an Aflac policy can help.

FYI – Aflac processes most claims in about 4 business days and benefits are paid directly to the policy holder — not the hospital or doctor — to help with all costs and expenses, from rent and gas to childcare and groceries.

How well prepared are you when it comes to unexpected medical expenses? Have you ever been saved by an Aflac policy like we were? I’d love to hear your stories in the comments below!

Disclosure: I participated in a campaign on behalf of Mom Central Consulting for Aflac. I received a promotional item as a thank you for participating.

© 2013, Food Fun Family. All rights reserved.

That is so fortunate! It’s scary to think of life without insurance, and major medical can be so expensive on your own. I’m glad Aflac took care of you guys!

BOY! am I glad you were ready!!!

Yes, my husband had to have shoulder surgery last year. We had put it off until we couldn’t put it off any longer. 5 months of being totally disabled and out of work. In Utah, there is no state disability insurance or any safety net for medical issues unless your company offers something. If you can’t work, you just go without. Fortunately, we had an Aflac policy through his tiny company and a very small private disability policy that we had purchased so long ago, they had to dig into the microfiche to discover our coverage amounts. Between the two of them, it was enough to keep the house payment paid and keep us afloat. Otherwise, it could have been much harder.