Of all the things I’ve taught my kids, especially those things I’ve taught them over the last few years of financial struggle in our family, one of the most valuable lessons has been that of frugal living.

I was raised with plenty. I never considered my family rich, but we had everything we needed. Before I got married, Candyman expressed his concern about the “life of ease” that I was accustomed to, and then, later, expressed his surprise that I was one of the most frugal people he knew. I am grateful that my parents taught me the value of money and the way to save, share, and spend money wisely.

My family’s financial situation right now is quite a bit rockier than my own experience as a child, and so it has been even more important for me to teach my children how to manage their money, and how to respect the money that Mom and Dad earn.

My family’s financial situation right now is quite a bit rockier than my own experience as a child, and so it has been even more important for me to teach my children how to manage their money, and how to respect the money that Mom and Dad earn.

Last month, I was approached by Kidworth, an online money management tool for families, to review their website and services, and I couldn’t be more excited to share it, especially in light of this statistic:

Did you know kids get an average of $25,000 in gifts and cash from 0-18? Yet most children have a net worth of zero when they leave home.

I have watched my own kids develop their own, unique tendencies toward money. Some of my kids get birthday cash and can’t wait to go out and blow it all in one shot. Others are natural savers and are eager to put their money away for a larger goal. Kitkat has impressed me with the money jar in her room. Every time she spends a little bit of cash, she puts the change in a jar and so far has collected over $50 in coins.

I have watched Twizzler opt against buying a toy in favor of saving his cash for a “better deal” or a larger toy that he could buy with a little more money.

Teaching kids to save and spend wisely is tough, and each child is different. I think it is crucial to give children the experience of setting financial goals and the opportunity to work towards those goals.

What is Kidworth?

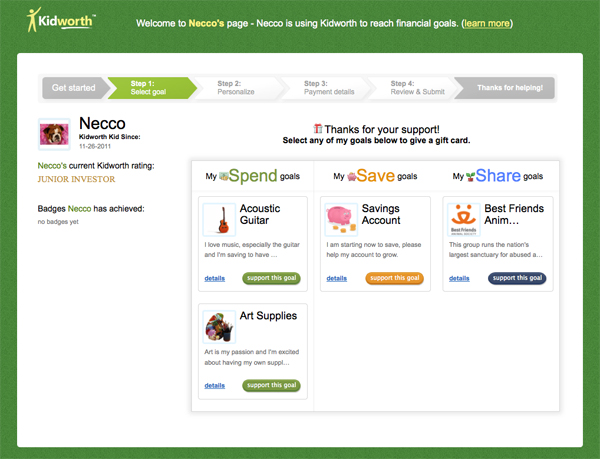

Kidworth is a free service for parents to help teach children money management that will last a lifetime. Kidworth’s service allows parents to set up accounts for their children, create goals each child is working towards, and invite family and friends to help via emails, social sharing, and invites.

Kidworth’s mission is to teach kids to set financial goals and help them achieve their goals. Family members and friends can pitch in for their goals for holidays and special occasions through a private page that is set up for your child.

I signed each of my kids up for a free Kidworth account and talked to them about what they would like to save their money for. Here’s an example of a Kidworth profile page:

Why use Kidworth this holiday season

With our extended family spread out between the West Coast and East Coast, I can expect to get a few calls and emails asking what the kids want for Christmas or their birthdays. So often, what the kids really want is more than an aunt or uncle would typically get for them, and it’s also frequently an item that wouldn’t ship well. I’ve also noticed that the older my kids get, the more they want to pick out their gifts themselves, and they seem to appreciate the gift of money more than a random present.

Sign up for Kidworth: Now is a great time to set up a Kidworth account, and invite family and friends to give the gift of financial responsibility.

Join the weekly twitter chats with Kidworth

I will be co-hosting a twitter chat with Kidworth on Tuesday, November 29 at 1:00pm EST. I would love for you to come join the chat! Just follow the hashtag #Kidworth. Kidworth will be holding live chats every Tuesday at 1:00pm and every Thursday at 9:00pm EST. The chats are sure to be fun and very informative!

Connect with Kidworth on twitter @Kidworth and on the Kidworth Facebook page.

Disclosure: This is a sponsored post, written by me on behalf of Kidworth. The opinions expressed are my own.

© 2011 – 2016, Food Fun Family. All rights reserved.

This sounds like a nice idea to help kids appreciate the value of saving. i can’t believe kids get so much $ in cash and gifts!